Insights into 2025 robotics funding and growth in robotics market segments

Fastest growing segments are defense, software and industrial robotics

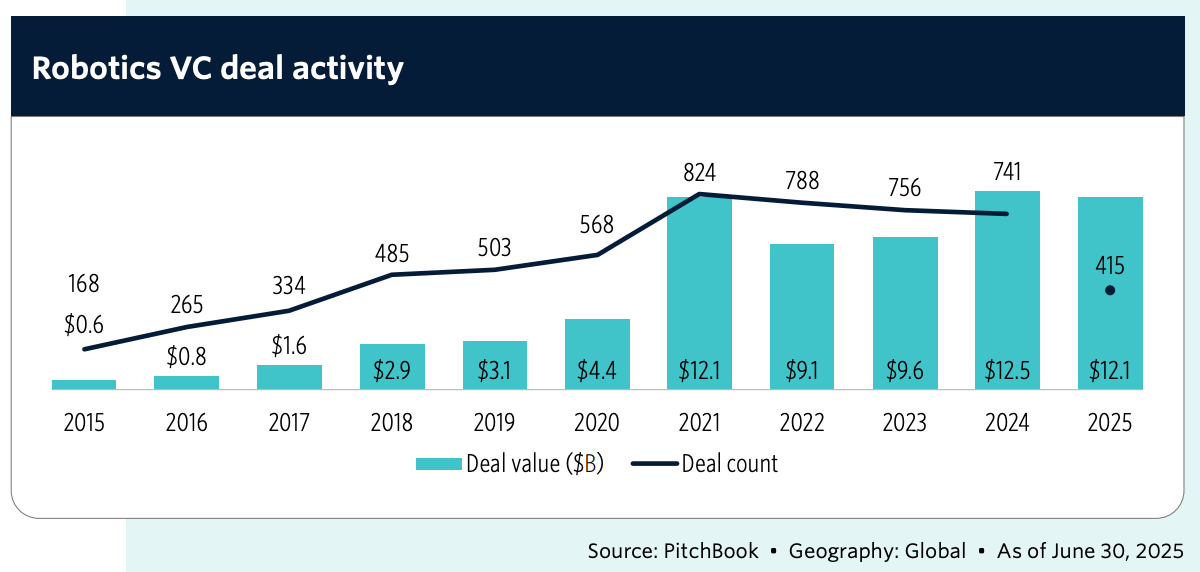

Robotics investment has rebounded in 2025. Deal value surged in Q2 2025 to $8.8 billion, up 170.5% QoQ and 263.2% in the trailing 12 months (TTM) across 221 deals, highlighting the return of mega-rounds and investor confidence in late-stage startups.

The data suggests that the market for robotics is set to grow, projected to expand globally from $357 billion in 2025 to between $1.2 trillion and $1.5 trillion by 2030. There is also consolidation in the robotics landscape, with more late stage investment compared to early stage investment.

Pitchbook have just released a vertical snapshot of robotics funding in 2025, with four overarching themes emerging from the deal activity:

1. Defense robotics is the core growth engine: Multibillion-dollar inflows into unmanned aerial, ground, and maritime systems reflect geopolitical tailwinds and growing defense budgets.

2. Software is eating robotics: Autonomy platforms, computer vision, and navigation tools are scaling rapidly as capital-light, cross-platform plays.

3. Capital is consolidating: Industrial and logistics robotics continue to attract funding, but deal counts are flat or declining, signaling a shift toward larger late-stage rounds rather than broad experimentation.

4. Divergence is evident across the consumer, healthcare, and agriculture segments. Companion and domestic robots are gaining traction while entertainment robotics shrinks. Surgical and rehabilitation systems are growing while hospital logistics struggles. Meanwhile, agricultural robotics remains flat aside from food processing & packaging gains.

Keep reading with a 7-day free trial

Subscribe to Robots & Startups to keep reading this post and get 7 days of free access to the full post archives.